The NCUA Board shall issue a pro rata equity distribution from the Share Insurance Fund to eligible federally insured credit unions after each calendar year if, as of the end of that calendar year:

- Any loans to the Share Insurance Fund from the federal government and any interest on those loans have been repaid;

- The Share Insurance Fund's equity ratio exceeds the normal operating level; and

- The Share Insurance Fund's available assets ratio exceeds 1.0 percent.

Per the Federal Credit Union Act, the NCUA Board shall distribute the maximum possible amount that does not reduce the Share Insurance Fund's equity ratio below the normal operating level and does not reduce the fund’s available assets ratio below 1.0 percent.

Methodology

In a final rule approved in February 2018, the Board established the following method for allocating distributions:

- For distributions related to the Corporate System Resolution Program (those made in respect of calendar years 2017 through 2021), each eligible financial institution’s pro rata distribution will be based on the average insured shares reported in quarterly Call Reports extending back to the beginning of calendar year 2009, which marks the beginning of the Corporate System Resolution Program and the first calendar year in which the Board charged corporate assessments.

- For distributions after 2021, an eligible financial institution’s pro rata share would be based on its quarterly average insured share balance as then reported over the calendar year in four quarterly Call Reports.

- Eligible institutions are those that filed a quarterly Call Report as a federally insured credit union for at least one reporting period in the calendar year for which the distribution is declared (March 31, June 30, September 30 or December 31).

2018 Distribution

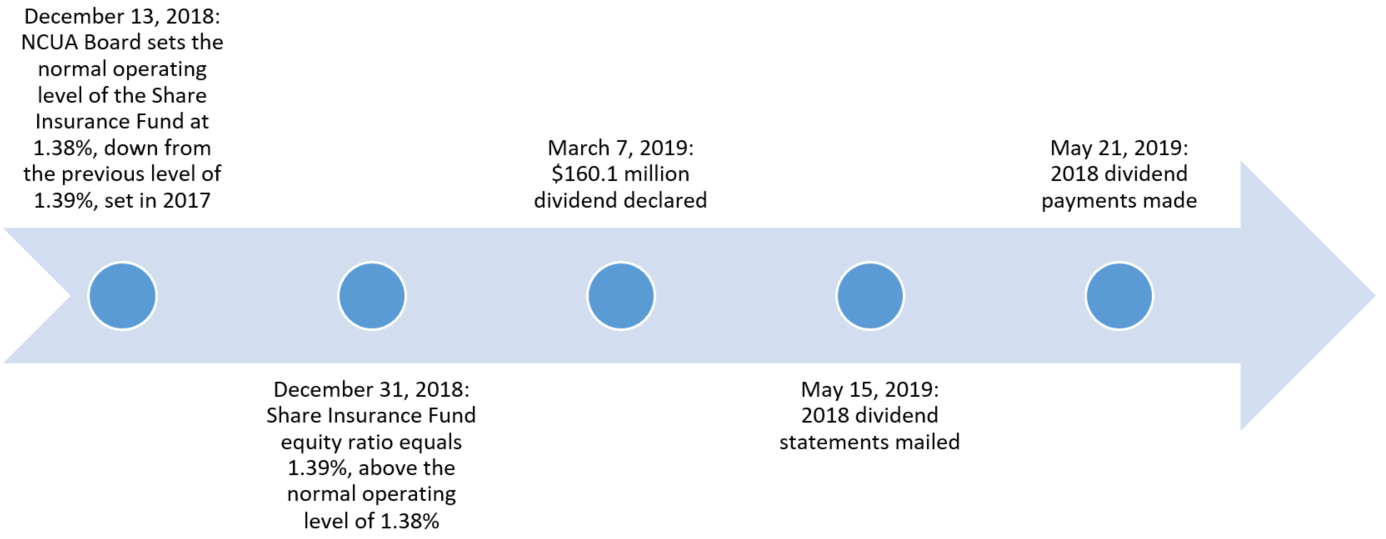

On March 7, 2019, the National Credit Union Administration Board declared a $160.1 million dividend to eligible institutions to be paid in the second quarter of 2019.

- Share Insurance Dividend Payments to Occur the Week of May 20

- March 7, 2019 Press Release Announcing Approval of 2018 Equity Distribution

- Equity Distribution Rule, 2018 FAQs

- Accounting for the 2018 Equity Distribution

- 2018 Share Insurance Fund Equity Distribution Explanatory Dividend Statement

2018 Distribution Timeline

2017 Distribution

At its February 2018 open meeting, the National Credit Union Administration Board declared a $735.7 million dividend to eligible institutions to be paid in the third quarter 2018.

- July 17, 2018 Press Release Announcing the 2017 Equity Distribution Will Occur the Week of July 23

- Accounting for the 2017 Distribution

- Equity Distribution Rule, 2017 FAQs

- Board Action Bulletin: NCUA Board Approves $736 Million Share Insurance Distribution in Q3 2018

- Board Action Memorandum

- Board Presentation