General Questions

What is Prompt Corrective Action (PCA)?

The purpose of prompt corrective action is to resolve the problems of federally insured credit unions at the least possible long-term loss to the National Credit Union Share Insurance Fund. Subparts A and B to NCUA Rules and Regulations Part 702, carry out the purpose of PCA by establishing a framework of minimum capital requirements, and mandatory and discretionary supervisory actions applicable according to a credit union’s capital classification, designed primarily to restore and improve the capital adequacy of federally insured credit unions. Capital classifications are primarily determined by a federally insured credit union’s PCA net worth ratio, and for complex federally insured credit unions, a risk-based capital measure, as reported on the NCUA’s Call Report each quarter.

If a credit union’s capital classification falls below well capitalized to adequately capitalized or lower, credit unions must follow § 702.106, to meet the earnings retention requirements.

If a credit union’s capital classification falls to undercapitalized or lower, a credit union must follow mandatory supervisory actions required under § 702.107-§702.109, which include earnings retention requirements, submission of a net worth restoration plan (NWRP), and other restrictions.

If a credit union meets the definition of a new credit union, alternative prompt corrective action requirements are defined under Subpart B of NCUA Rules and Regulations Part 702. A new credit union is defined as a credit union that has been operating less than 10 years and has total assets of not more than $10 million.

Close and return to topHow is the "net worth ratio" calculated?

The net worth ratio means the ratio of the credit union's net worth to total assets, expressed as a percentage rounded to two decimal places. Section §702.2 defines the terms “net worth,” “total assets,” and “net worth ratio.”

The Call Report's Capital Adequacy Worksheet (currently on page 22 of the Call Report Form) details the components of the net worth ratio.

Under § 702.2, the term “total assets” has four available measurements for the credit union to use:

- Quarter-end balance;

- Average quarterly balance;

- Average monthly balance; or,

- Average daily balance.

A credit union can change its “total assets” election each quarter (default is quarter-end balance).

Here is an example of how using an optional “total assets” election of average quarterly balance, average monthly balance; or average daily balance, can affect the credit union's official net worth ratio.

| Call Report Field | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 |

|---|---|---|---|---|---|

| Stated Total Assets | $694,518,536 | $697,531,110 | $694,829,795 | $707,312,984 | $712,986,289 |

| Quarter-end Net Worth | $46,919,657 | $49,654,274 | $50,491,666 | $51,975,960 | $52,758,195 |

| Net Worth to Total Assets | 6.75% | 7.11% | 7.26% | 7.34% | 7.39% |

| Net Worth to Total Assets - using Optional total Assets Election | 6.81% | 7.14% | 7.29% | 7.44% | 7.50% |

| Total Assets Election (Optional)i | $688,931,249 | $694,491,330 | $691,717,404 | $698,548,106 | $703,041,403 |

How do I determine my Capital Classification?

At the end of each calendar quarter, a credit union’s capital classification is determined by the net worth ratio. A complex credit union’s capital classification is determined by the net worth ratio and either the risk-based capital ratio or the complex credit union leverage ratio (CCULR), if the complex credit union is qualifying and has elected to use the CCULR ratio. A credit union is defined as complex when assets are greater than $500 million as of quarter-end. The following table illustrates the capital classifications based on the capital framework guiding credit unions.

| Capital classification | Net worth ratio | And/Or | Risk-based capital ratio, if applicable | Or | Complex Credit Union Leverage Ratio, if applicable | And subject to following condition(s) |

|---|---|---|---|---|---|---|

| Well Capitalized | 7% or greater | And | 10% or greater | Or | 9% or greater* | N/A |

| Adequately Capitalized | 6% or greater | And | 8% or Greater | Or | N/A | And does not meet the criteria to be classified as well capitalized. |

| Undercapitalized | 4% to 5.99% | Or | Less than 8% | Or | N/A | N/A |

| Significantly Undercapitalized | 2% to 3.99% | Blank | N/A | Blank | N/A | Or if "undercapitalized” at <5% net worth and (a) fails to timely submit, (b) fails to materially implement, or (c) receives notice of the rejection of a net worth restoration plan. |

| Critically Undercapitalized | Less than 2% | Blank | N/A | Blank | N/A | N/A |

* A qualifying complex credit union opting into the CCULR framework should refer to § 702.104(d)(7) if its CCULR falls below 9.0 percent.

Close and return to topAre capital classifications different for “new” credit unions?

Alternative PCA requirements for “new” credit unions are defined under NCUA Rules and Regulations, Subpart B to Part 702. Credit unions are considered new if they have been operating less than 10 years and total assets are $10 million or less.

The following table illustrates the capital classifications for new credit unions.

| Capital classification | Net worth ratio |

|---|---|

| Well Capitalized | 7% or greater |

| Adequately Capitalized | 6% to 6.99% |

| Moderately Capitalized | 3.5% to 5.99% |

| Marginally Capitalized | 2% to 3.49% |

| Minimally Capitalized | 0% to 1.99% |

| Uncapitalized | Less than 0% |

What is the Risk-Based Capital (RBC) Ratio?

The RBC ratio means the percentage, rounded to two decimal places, of the risk-based capital ratio numerator to risk-weighted assets, as calculated in accordance with § 702.104(a)-(c).

There are additional resources on RBC here.

Close and return to topWhat is the Complex Credit Union Leverage Ratio (CCULR)?

The Complex Credit Union Leverage Ratio or CCULR is calculated by taking the total net worth of the credit union divided by total assets.ii A complex credit union that wants to use CCULR instead of RBC for purposes of its PCA capital classification must opt in to the CCULR framework by completing the applicable reporting requirements on the Call Report. To opt in to the CCULR framework, a complex credit union must meet the regulatory requirements, under § 702.104(d). If all the regulatory requirements are met, the complex credit union would be considered well capitalized and is not required to calculate its RBC ratio.

Close and return to topIs there an "effective date" for PCA purposes?

Yes, there is an effective date per § 702.101(c). It is the most recent of:

- The last day of the calendar month following the end of the calendar quarter. This is the most typical effective date and determined by the Call Report cycle.

5300 Cycle Classification Effective Date December 31 January 31 March 31 April 30 June 30 July 31 September 30 October 31 - Corrected capital classification. The date the credit union received subsequent written notice from NCUA or, if state-chartered, from the appropriate state official, of a decline in capital classification due to correction of an error or misstatement in the credit union's most recent Call Report; or

- Reclassification to lower category. The date the credit union received written notice from NCUA or, if state-chartered, the appropriate state official, of reclassification on safety and soundness grounds as provided under § 702.102(b) or § 702. 202(d).

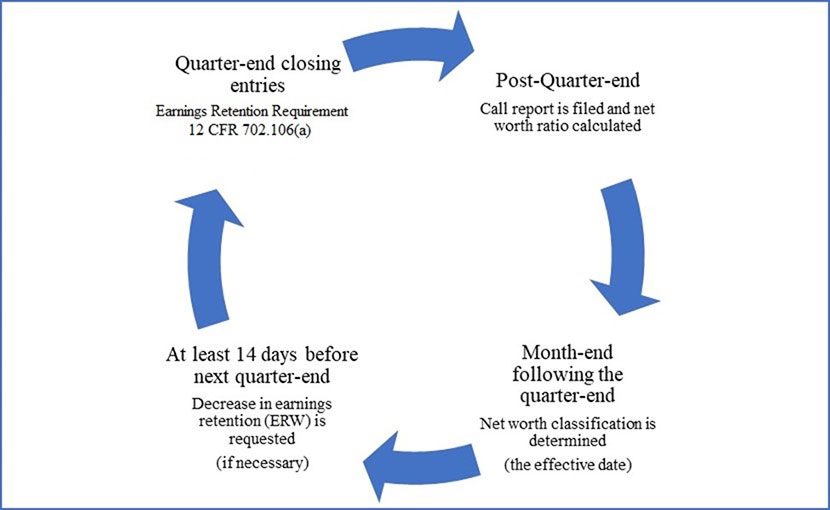

What is the general PCA process?

Below is an illustration of the timing of the net worth determination and actions required when a credit union’s net worth triggers PCA actions.

- Quarter-end closing entries – Earnings Retention Requirement 12 CFR 702.106(a)

- Post-Quarter-end – Call report is filed and net worth ratio calculated

- Month-end following the quarter-end – Net worth classification is determined (the effective date)

- At least 14 days before next quarter-end – Decrease in earnings retention (ERW) is requested (if necessary)

When is the earnings retention required?

Beginning on the effective date of classification as "adequately capitalized" or lower, a federally insured credit union must increase the dollar amount of its net worth quarterly (either in the current quarter, or on average over the current and three preceding quarters), by an amount equivalent to at least 1/10th percent (0.1 percent) of its total assets until it is "well capitalized."

Here is a hypothetical example. Sample FCU's capital classification has historically been well capitalized. In 2023, due to a combination of erratic quarterly net income and growth levels, Sample FCU's capital classification dropped below well capitalized. Let us look at Sample FCU's requirements for the 0.10 percent quarterly earnings retention requirement.

| 5300 Cycle/Qtr. | 12/31/2022 | 3/31/2023 | 6/30/2023 | 9/30/2023 | 12/31/2023 | 3/31/2024 |

|---|---|---|---|---|---|---|

| Capital Classification | Well Capitalized | Adequately Capitalized | Well Capitalized | Well Capitalized | Adequately Capitalized | Well Capitalized |

| Earnings Retention Required | N/A | No Earnings Retention Required | 0.1% Retention Required | No Earnings Retention Required | No Earnings Retention Required | 0.1% Retention Required |

Sample FCU must retain earnings at the quarter end following the effective date of a classification below "well capitalized" (based on the net worth ratio or risk-based measure that triggers the classification). Keep in mind, the effective date is the month-end after the quarter-end: January 31, April 30, July 31, or October 31.

If the credit union cannot retain (earn) the required earnings, the credit union must request a decrease in the earnings retention also referred to as an earnings retention waiver from the appropriate Regional Director at least 14 days before the end of the quarter. If a credit union is unsure if it will be able to make the 0.10 percent earnings required, a waiver request as an abundance of caution would also be required as to not violate the regulation.

If the credit union ends up earning enough to meet the retention requirement, it must retain the earnings as required. If, however, the credit union did not make the required earnings and the waiver was needed, the credit union will have complied with the requirement to request permission in advance of the quarter-end.

Close and return to topWhen is an earnings retention waiver (ERW) due?

As noted above, a credit union must submit an ERW at least 14 days before the close of the quarter for which an ERW is requested. See the table below for guidance.

| Quarter-End | No Later Than |

|---|---|

| March 31 | March 17 |

| June 30 | June 16 |

| September 30 | September 16 |

| December 31 | December 17 |

When is a Revised Business Plan (RBP) required?

A RBP is required for "new" credit unions. A “new” credit union is defined as less than 10 years old and assets $10 million or less. New credit unions must submit a RBP to the regional office within 30 calendar days of being classified as moderately or lower capitalized, per § 702.204(a)(2), (3). The NCUA Board may notify the credit union in writing that its RBP is to be filed within a different period or that it is not necessary to file an RBP, see NCUA Rules and Regulations § 702.206.

As an example, if Sample FCU is a new credit union and its capital classification dropped to "moderately capitalized" or lower as of the June 30 Call Report, its RBP would be due August 30.

The chart below details the different RBP due dates by quarter-end and classification date.

| Quarter-End | Effective Date of Net Worth Classification | "New" Credit Union RBP Must Be Received NLT |

|---|---|---|

| December 31 | January 31 | +30 days = March 23 |

| March 31 | April 30 | +30 days = May 30 |

| June 30 | July 31 | +30 days = August 30 |

| September 30 | October 31 | +30 days = November 30 |

When is a Net Worth Restoration Plan (NWRP) required?

A federally insured credit union must submit a NWRP within 45 calendar days of the effective date of a capital classification below "adequately capitalized” in accordance with § 702.111.

For example, if Sample FCU's capital classification dropped below "adequately capitalized" as of the June 30 Call Report, its NWRP would be due September 14.

The chart below details the different RBP and NWRP due dates by quarter-end and classification date.

| Quarter-End | Effective Date of Net Worth Classification | Federally Insured Credit Union NWRP Must Be Received NLT |

|---|---|---|

| December 31 | January 31 | +45 days = March 164 |

| March 31 | April 30 | +45 days = June 14 |

| June 30 | July 31 | +45 days = September 14 |

| September 30 | October 31 | +45 days = December 15 |

What resources are available to help a credit union complete the NWRP or RBP?

The following resources are also available in the Videos section and the Resource Guide section on this website:

NCUA assistance may be available to help the credit union complete the NWRP or RBP. Contact your district examiner or the Office of Credit Union Resources and Expansion for details if you need help.

Close and return to topWhat does a successful NWRP or RBP include?

A NWRP or RBP must specify the following:

- Quarterly timetable showing net worth reaching "adequately capitalized" and remaining so for four consecutive quarters and for new credit unions until the credit union becomes adequately capitalized by the time it no longer qualifies as “new.” (Note-Complex credit unions should also include the RBC requirements.)

- Projected amount of earnings retention for each quarter of the NWRP/RBP. (Note-To comply with the earnings retention requirement, the credit union must show positive net income for the quarter. If a loss is projected for the quarter, the earnings retention would be $0. The plan then serves as an earnings retention waiver for that quarter.)

- Explanation of how the credit union will comply with mandatory and discretionary supervisory actions.

- Explanation of the types and levels of activities in which the credit union will engage.

- NWRP’s require quarterly proforma financial statements for a minimum of two years, or the length of the plan.

- Explanation of steps the credit union will take to correct unsafe or unsound practices/conditions if the credit union is reclassified to a lower capital classification triggering a NWRP or RBP.

- RBP only-Address changes made since the original business plan was approved.

An approved NWRP or RBP will:

- Include realistic assumptions and accurate projections that allow the credit union to succeed in building net worth.

- Not increase the credit union's exposure to risk to an unreasonable level.

Footnotes

i The example credit union used the average of the three month-end balances over the calendar quarter election, and the average of the current and three preceding calendar quarter-end balances election via the NCUA 5300 Call Report.

ii Calculation of the CCULR. A qualifying complex credit union opting into the CCULR framework under paragraph (d) of § 702.104 calculates its CCULR in the same manner as its net worth ratio under § 702.2.

3 The RBP due date is generally 3/2. However, during leap years the due date will be 3/1.

4 The NWRP due date is 3/17 in a normal year. However, in a leap year the due date would be 3/16.