Disclaimer

This document summarizes and analyzes the weaknesses believed to have caused certain credit unions to seek a merger partner for other than strategic or member service reasons over a recent 5-year period and identifies some leading practices credit unions may consider in their own operations to avoid similar problems that may contribute to the decision to merge. While the NCUA believes the observations and leading practices in this document might have addressed or even eliminated the problems present that led to a merger, each credit union merger involves unique circumstances that, taken together, inform the credit union board’s decision to seek merger to ensure ongoing service to the credit union’s members. Thus, implementing one or more of the practices in this report may not ensure continued viability. Even if a credit union takes actions consistent with these practices, NCUA examiners will review the practices and assess the credit union’s strengths and weaknesses as they would in any examination. The practices are general guidance, advice, and suggestions that are not intended to create new, binding requirements or to supersede existing requirements.

The NCUA takes reasonable measures to ensure the quality of the information contained in this document, but it makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy or effectiveness of the information or industry standards, nor does it represent that the use of the information or practices discussed, nor does it represent that the use of the information and practices would not infringe upon privately owned rights.

Background

The NCUA’s Office of Examination and Insurance (E&I) reviewed 613 credit union mergers from 2017 to 2021. Of the 613, 12 were assisted mergers and the remainder were mergers with no assistance from the NCUA.1 Voluntary mergers are initiated and approved by a credit union’s board and membership.2

Mergers between credit unions are common. The reasons for voluntarily merging vary by credit union. For example, for the continuing credit union, mergers may be a strategic decision as part of the credit union’s growth strategy, while the merging credit union’s management may be seeking to expand services for the members.

The purpose of the review is to identify:

- The trends in mergers;

- The reasons why credit unions voluntarily merge; and

- Practices that may help credit unions avoid problems that may contribute to a decision to merge.

Merger Trends

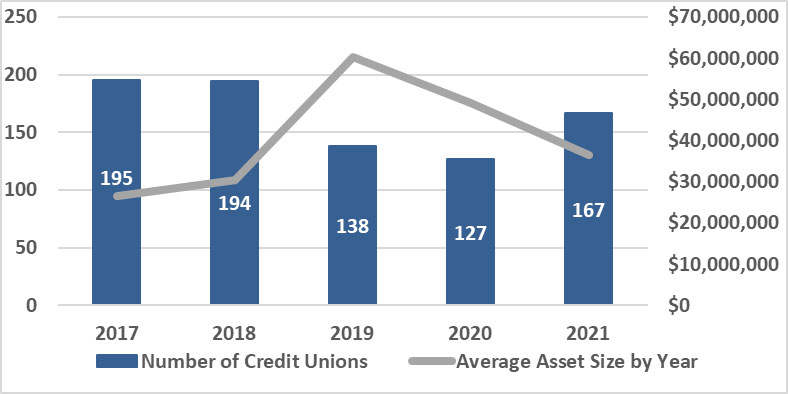

The following chart summarizes the number of mergers by year and the average asset size of the merging credit unions.

Credit Union Mergers 2017 to 2021

The increase in average asset size of merging credit unions in the last few years reflects an emerging trend of larger, financially healthier credit unions merging with like-sized, healthy credit unions. For example, in 2020, two credit unions, each with assets in excess of $1 billion, voluntarily merged. Both the merging credit union and the continuing credit union were all well capitalized at the time of the merger.

Why Credit Unions Merge

Credit union mergers typically happen for multiple reasons. For example, a credit union may merge to expand services. However, other factors can contribute to the decision to merge, such as declining membership or financial performance problems.

When the NCUA collects data on merging credit unions, the agency asks the credit unions to identify the primary reason for the merger. Overwhelmingly, the primary reason provided for mergers was “expanded services,” at approximately 76 percent of all mergers. The next most prevalent reason was “poor financial condition,” at approximately 13 percent.

The following table shows 5 years of data on the reasons credit unions provided for their merger. As noted, in many cases the primary reason for the merger was not the only reason.

Mergers by Primary Reason (2017-2021)

| Primary Merger Reason | Assets of Merged Credit Unions | # Of Mergers | % Of Mergers | Average Asset Size | Involuntary | Voluntary |

|---|---|---|---|---|---|---|

Primary Merger Reason Expanded Services |

Assets of Merged Credit Unions $25,490,689,714 |

# Of Mergers 624 |

% Of Mergers 76.00% |

Average Asset Size $40,850,464 |

Involuntary 6 |

Voluntary 618 |

Primary Merger Reason Poor Financial Condition |

Assets of Merged Credit Unions $2,529,957,203 |

# Of Mergers 102 |

% Of Mergers 12.42% |

Average Asset Size $24,803,502 |

Involuntary 9 |

Voluntary 93 |

Primary Merger Reason Inability to Obtain Officials |

Assets of Merged Credit Unions $544,986,792 |

# Of Mergers 24 |

% Of Mergers 2.92% |

Average Asset Size $22,707,783 |

Involuntary 0 |

Voluntary 24 |

Primary Merger Reason Lack of Sponsor Support |

Assets of Merged Credit Unions $304,602,872 |

# Of Mergers 22 |

% Of Mergers 2.68% |

Average Asset Size $13,845,585 |

Involuntary 0 |

Voluntary 22 |

Primary Merger Reason Loss/Declining FOM |

Assets of Merged Credit Unions $67,050,627 |

# Of Mergers 13 |

% Of Mergers 1.58% |

Average Asset Size $5,157,741 |

Involuntary 1 |

Voluntary 12 |

Primary Merger Reason Poor Management |

Assets of Merged Credit Unions $379,552,494 |

# Of Mergers 12 |

% Of Mergers 1.46% |

Average Asset Size $31,629,375 |

Involuntary 1 |

Voluntary 11 |

Primary Merger Reason Lack of Growth |

Assets of Merged Credit Unions $639,588,527 |

# Of Mergers 12 |

% Of Mergers 1.46% |

Average Asset Size $53,299,044 |

Involuntary 0 |

Voluntary 12 |

Primary Merger Reason Conversion to or Merger with FISCU |

Assets of Merged Credit Unions $129,704,893 |

# Of Mergers 7 |

% Of Mergers 0.85% |

Average Asset Size $18,529,270 |

Involuntary 0 |

Voluntary 7 |

Primary Merger Reason Conversion to or Merger with NFICU |

Assets of Merged Credit Unions $72,335,686 |

# Of Mergers 3 |

% Of Mergers 0.37% |

Average Asset Size $24,111,895 |

Involuntary 0 |

Voluntary 3 |

Primary Merger Reason Conversion to or Merger with FCU |

Assets of Merged Credit Unions $2,761,203 |

# Of Mergers 1 |

% Of Mergers 0.12% |

Average Asset Size $2,761,203 |

Involuntary 0 |

Voluntary 1 |

Primary Merger Reason Corporate Restructuring |

Assets of Merged Credit Unions $1,528,428,718 |

# Of Mergers 1 |

% Of Mergers 0.12% |

Average Asset Size $1,528,428,718 |

Involuntary 0 |

Voluntary 1 |

Primary Merger Reason Totals |

Assets of Merged Credit Unions $31,689,658,729 |

# Of Mergers 821 |

% Of Mergers Blank |

Average Asset Size $38,598,854 |

Involuntary 17 |

Voluntary 804 |

Note. FISCU = Federally Insured State-Chartered Credit Union; FOM = Field of Membership; FCU = Federal Credit Union; NFICU = Non-Federally Insured Credit Union.

Leading Practices

Credit unions should consider the leading practices listed below to avoid problems that may contribute to a decision to merge for reasons other than a strategic or member service purpose.

Strategic Planning

- Develop reasonable strategic and business plans with measurable short- and long-term goals.3

- Reassess the plan periodically for progress and effectiveness.

- Include a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis that focuses on the field of membership, geographic market, industries included in the FOM, and general operations.

- Develop action steps to achieve goals.

- Align the annual budget with the strategic plan.

Succession Planning

- Ensure the succession plan addresses key employees and officials.

Attracting Volunteers for the Board and Committees

- Get the message out to the membership - social media, annual meeting, signs in the credit union.

- Consider creating an associate board member position(s). While this individual(s) would not have voting rights on the board, it is a good learning tool for those who want to be board members. Further, it allows the individual to understand the role prior to serving as a member of the board if elected.

- Address volunteers in the credit union’s succession planning.

Generating Loans

- Set reasonable loan portfolio goals in the strategic and business plans, consistent with the credit union’s operational and financial ability to safely meet these goals.

- Set action steps to achieve goals.

- Identify the root problem for any decline in loan volume.

- Consider various options, including purchasing loans and loan participations, to achieve growth goals when the credit union can safely conduct and manage this activity.

Heavy Reliance on Sponsor for Ongoing Operations

- Consider a written agreement for sponsor-provided credit union space that serves as a legal protection to the credit union for a period of time and provides the credit union early notice and lead time to secure alternative operating arrangements should the business relationship change.

- Have a contingency plan if it becomes necessary to seek another facility from which to operate the credit union.

Financial Performance

- Implement a sound business and strategic plan.

- Monitor credit union activities in accordance with your strategic plans and adjust as needed. In particular, closely monitor credit, interest rate, and liquidity risk.

- Develop concentration risk policies and procedures.

Recordkeeping

- Train staff to carry out job functions.

- Perform account reconciliations under a dual control system, where one employee prepares the reconciliation and another employee reviews and approves the reconciliation.

- Implement a reasonable system of internal controls and an audit program to serve as a deterrent to fraud.

Services and Technology

- Conduct periodic membership polls to determine what additional products and services the credit union should consider offering.

- Determine what technology changes are needed.

- Seek out a partner — in other words, another credit union, credit union service organization, or third party — to help provide additional services.

Footnotes

1 The NCUA’s National Supervision Policy Manual (19.0) defines an assisted merger as one that requires direct NCUA involvement (other than merely approving the transaction).

2 NCUA regulations This is an external link to a website belonging to another federal agency, private organization, or commercial entity. Part 708b (Opens new window) , Mergers of Insured Credit Unions into Other Credit Unions; Voluntary Termination or Conversion of Insured Status.

3 Strategic planning involves a systematic process to develop a long-term vision. The strategic plan incorporates all areas operations and sets broad goals that inform sound decisions. The strategic plan identifies risks and threats to the organization and outlines methods to address them. As part of the strategic planning process, it is prudent to develop a business plan for the next one or two years. The business plan should be consistent with the organization’s strategic plan, and the budget and business plan should be aligned.