Credit unions today are thriving. Here's a look at their history in the United States.

Historical Timeline

1901

Alphonse Desjardins brings credit unions to North America as the Canadian journalist organizes La Caisse Populaire de Levis (The People's Bank of Levis) in his home in Levis, Quebec. The first deposit was just 10 cents.

Alphonse Desjardins brings credit unions to North America as the Canadian journalist organizes La Caisse Populaire de Levis (The People's Bank of Levis) in his home in Levis, Quebec. The first deposit was just 10 cents.

1909

April 6, 1909 – St. Mary's Cooperative Credit Association, the first U.S. credit union, opens in Manchester, New Hampshire, with assistance from Alphonse Desjardins.

Massachusetts Bank Commissioner Pierre Jay and wealthy Boston merchant Edward A. Filene join forces to enact the Massachusetts Credit Union Act, the first general statute for establishing credit unions in the United States. For his efforts, Filene earns the moniker "Father of U.S. Credit Unions."

1920

Filene hires 40-year-old Massachusetts attorney Roy F. Bergengren to energize and expand a fledgling credit union movement. Bergengren is credited with developing today's credit union system.

Filene hires 40-year-old Massachusetts attorney Roy F. Bergengren to energize and expand a fledgling credit union movement. Bergengren is credited with developing today's credit union system.

1921

Filene and Bergengren organize the Credit Union National Extension Bureau, an association focused on forming new credit unions, enacting state laws to charter credit unions, and promoting the philosophy of credit unions. Between 1921 and 1935, 38 states and the District of Columbia enact credit union laws.

1929

The stock market crash of 1929 causes a financial crisis that ultimately leads to the Great Depression. At the height of the Great Depression, personal income, tax revenue, profits, and prices drop significantly, while international trade plunges by more than 50 percent. Unemployment in the U.S. rises to more than 25 percent.

1932

Bergengren meets with U.S. Senator Morris Sheppard of Texas to discuss the need to organize credit unions under federal law. Bergengren believes a U.S. law permitting federal credit unions to organize is imperative. "A federal credit union law would be a sort of blanket insurance policy for all our state laws, giving us an alternative method of organization," Bergengren writes.

1934

June 26, 1934 — President Franklin Delano Roosevelt signs the Federal Credit Union Act into law. The newly created Federal Credit Union Division is placed in the Farm Credit Administration, the agency responsible for addressing the financial problems facing rural America.

July 1934 — Claude Orchard, an executive at Armour & Company, is named head of the newly formed Federal Credit Union Division. Orchard leads the Federal Credit Union Division for 19 years, focusing primarily on developing the laws and regulations that govern credit unions.

Oct. 1, 1934 — Morris Sheppard Federal Credit Union in Texarkana, Texas, becomes the first federally chartered credit union.

1941

Dec. 7, 1941 — During the attack on Pearl Harbor, P.W. Eldred, the former treasurer of Hawaiian Air Depot Federal Credit Union on the island of Oahu, was killed when he attempted to save the credit union’s records that were located in an office at Hickam Army Airfield. The credit union’s office was also demolished when a bomb destroyed the hangar it was located in. More than 2,400 American service members and civilians were killed during the attack.

Dec. 7, 1941 — During the attack on Pearl Harbor, P.W. Eldred, the former treasurer of Hawaiian Air Depot Federal Credit Union on the island of Oahu, was killed when he attempted to save the credit union’s records that were located in an office at Hickam Army Airfield. The credit union’s office was also demolished when a bomb destroyed the hangar it was located in. More than 2,400 American service members and civilians were killed during the attack.

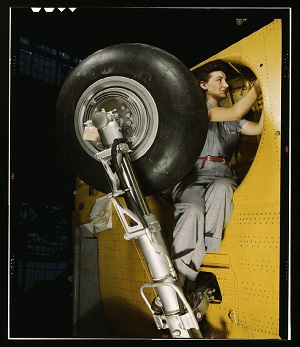

1942

Federal supervision of credit unions is transferred to the Federal Deposit Insurance Corporation.

1945

As part of the U.S. war effort during World War II, credit unions sell 12 million war bonds with a purchase price of $404 million — that equals more than $5.7 billion in 2018 dollars.

As part of the U.S. war effort during World War II, credit unions sell 12 million war bonds with a purchase price of $404 million — that equals more than $5.7 billion in 2018 dollars.

1948

The Federal Credit Union Division is renamed the Bureau of Federal Credit Unions, and is moved from the Federal Deposit Insurance Corporation to the Federal Security Agency.

1951

With the passage of the Revenue Act of 1951, federal and state-chartered credit unions are granted an exemption from the federal income tax.

1952

By 1952, the number of federal credit unions grows to nearly 6,000 with more than 2.8 million members.

1953

J. Dean Gannon becomes director of the Bureau of Federal Credit Unions as it moves to the new Department of Health, Education and Welfare. Over the next 17 years, the Bureau becomes self-sufficient, financed by fees on federal credit unions.

1960

By the end of 1960, there were 9,905 federal credit unions with 6.1 million members and $2.7 billion in assets.

1966

In February 1966, the Bureau of Federal Credit Unions, along with other federal agencies launch Project Moneywise, an initiative to expand credit union services into low- to moderate-income areas across the country and improve the financial well-being of these communities. The program included chartering initiatives to expand the availability of credit union services in these areas, training on successful credit union operations and management, and financial literacy and personal finance education. The program runs from 1966 until 1972.

1967

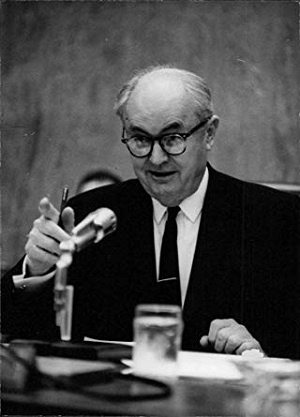

In November, Congressman John William Wright Patman of Texas introduces a bill for the creation of an independent federal regulator of credit unions. This bill, House Resolution (H.R.) 14030, fails to gain traction, but represents the first step in creation of what would become the National Credit Union Administration.

In November, Congressman John William Wright Patman of Texas introduces a bill for the creation of an independent federal regulator of credit unions. This bill, House Resolution (H.R.) 14030, fails to gain traction, but represents the first step in creation of what would become the National Credit Union Administration.

1970

Congress creates the National Credit Union Administration as an independent agency to charter and supervise federal credit unions. The National Credit Union Share Insurance Fund is also formed, insuring share deposits at federally insured credit unions up to $20,000. Until this point, credit unions had operated without federal deposit insurance.

Congress creates the National Credit Union Administration as an independent agency to charter and supervise federal credit unions. The National Credit Union Share Insurance Fund is also formed, insuring share deposits at federally insured credit unions up to $20,000. Until this point, credit unions had operated without federal deposit insurance.

Lieutenant General Herman Nickerson, Jr., becomes the first Administrator of the National Credit Union Administration.

1971

With the signing of Executive Order 11580 on January 20, President Richard Nixon establishes the original NCUA seal design. This design was the official seal of the agency until 2017.

1974

Legislation increases insurance coverage on credit union member share deposits to $40,000.

1976

C. Austin Montgomery is appointed NCUA Administrator.

1978

Lawrence Connell is appointed NCUA Administrator.

1979

A three-member Board replaces the NCUA Administrator as the governing body for the agency after Congress updates the Federal Credit Union Act. Board members are nominated and appointed by the President of the United States, and must be confirmed by the U.S. Senate. Board terms are set for staggered six-year terms, and not more than two members of the Board shall be members of the same political party. In appointing the Board, the president must designate the Chairman.

The first NCUA Board consists of former NCUA Administrator and newly appointed Chairman Lawrence Connell (1979–1981), Dr. Harold A. Black (1979–1981), and Vice Chairman P.A. Mack, Jr (1979–1987).

Congress also creates the Central Liquidity Facility. This facility is similar the Federal Reserve’s Discount Window and serves a similar function as the lender of last resort for the credit union system.

Share insurance coverage increases to $100,000 making it equal to the amount of deposit insurance coverage for banks provided by the Federal Deposit Insurance Corporation.

1981

More than 7,000 groups join existing credit unions under NCUA's new multiple select-employee group policy. Membership reaches 28.6 million. Credit union savings rise 20.7 percent, the number of loans grows 17.2 percent and assets increase 19.8 percent during the year. The credit union system's total assets surpass $100 billion.

The NCUA's Central Liquidity Facility and U.S. Central Credit Union, at the time the nation's largest corporate credit union, sign an agreement nearly quadrupling the Central Liquidity Facility's membership and giving 90 percent of credit unions a permanent source of backup liquidity.

Edgar F. Callahan becomes NCUA Board Chairman. He serves until 1985.

1982

Legislation grants NCUA emergency merger authority and temporary conservatorship authority.

Elizabeth F. Burkhart is appointed to the NCUA Board. She serves from 1982 to 1990.

1984

The U.S. Postal Service issues a commemorative stamp recognizing the 50th anniversary of the Federal Credit Union Act.

The U.S. Postal Service issues a commemorative stamp recognizing the 50th anniversary of the Federal Credit Union Act.

Administration of the Community Development Revolving Loan Fund is transferred to NCUA from the Department of Health and Human Services. Today, the Community Development Revolving Loan Fund provides grants and loans to low-income credit unions.

July 18, 1984 – The Deficit Reduction Act of 1984 is signed into law recapitalizing the National Credit Union Share Insurance Fund, which had been experiencing financial stress for several years. Federally insured credit unions submit $850 million or 1 percent of system assets at the time to fully capitalize a new, restructured Share Insurance Fund.

1985

Former U.S. Senator Roger W. Jepsen becomes Chairman of the NCUA Board. He serves as Chairman until 1993.

1987

On January 1, Governor Bruce Sundlun announces the Rhode Island Share Deposit Indemnity Corporation is insolvent and declares a "bank holiday" for 35 state-chartered credit unions and 10 state-chartered banks. The event precipitates a flood of insurance applications from privately insured credit unions nationwide. By 1991, 432 state-chartered credit unions will convert to federal insurance coverage.

The NCUA adopts the CAMEL Rating System (Capital, Asset Quality, Management, Earnings and Liquidity) as its rating system for credit unions.

1988

David Chatfield becomes an NCUA Board Member. He serves until 1989.

1989

The Asset Liquidation and Management Center in Austin, Texas, is created to deal with problem assets the NCUA acquires from both operating and liquidating credit unions. Over the years, the office’s role expands to include providing consulting services to the NCUA regional offices on such topics as lending analysis, records reconstruction, and fraud investigation. Renamed the Asset Management and Assistance Center in 1996, it also provides training to both NCUA and state credit union examiners.

1990

By the end of 1990, the credit union system has 12,891 federally insured credit unions, $223 billion in assets and 61 million members.

Robert Swan is appointed as an NCUA Board Member. He serves until 1996.

First National Bank & Trust in Asheboro, North Carolina, four other North Carolina Banks and the American Bankers Association sue the NCUA after the agency approved the field of membership expansion of AT&T Family Federal Credit Union so the credit union could serve small employee groups not related to the company. The lawsuit accuses the agency of violating the Federal Credit Union Act.

1991

Shirlee Bowné is appointed to the NCUA Board. She serves until 1997.

1993

During Norman E. D'Amours first year as Board Chairman, NCUA adds the Office of Corporate Credit Unions and the Office of Community Development Credit Unions. A former Congressman, D'Amours serves as Chairman until 2000.

1994

Sept. 1994 – The Washington D.C. District Court rules that NCUA’s policy of allowing for multiple groups in one field of membership is allowed under the Federal Credit Union Act. The American Bankers Association and other banking groups appeal the decision to the District Court of Appeals.

1995

The NCUA introduces the Automated Integrated Regulatory Examination System (AIRES). Updated versions of AIRES are still used by federal examiners and state supervisory authorities.

1996

July 1996 – The U.S. District Court of Appeals for the D.C. Circuit overturns the lower court’s decision and rules that all members of an occupation-based federal credit union must share one common bond. The appeals court orders the district court to apply its decision to AT&T Family Federal Credit Union. Additionally, in a separate lawsuit, the American Bankers Association and other banks ask for and are granted a nationwide injunction that applies to all federally chartered credit unions preventing them from adding new groups to their field of membership. The case is appealed to the U.S. Supreme Court.

Yolanda T. Wheat is appointed to the NCUA Board. She serves until 2001.

1997

Dennis Dollar is appointed to the NCUA Board.

Feb. 1997 – The U.S. Supreme Court agrees to hear the NCUA’s appeal of the Appeal Court’s ruling.

March 20, 1997 – H.R.1151, the Credit Union Membership Access Act is introduced in the House of Representatives. This bill would allow for multiple common bonds in federal credit union fields of membership.

1998

February 25, 1998 – The Supreme Court rules that federal occupation-based credit unions must consist of an occupational group having a single common bond. The resulting decision leaves open the potential that millions of credit union members could lose their membership.

April 1, 1998 – The House of Representatives passes the Credit Union Membership Access Act.

July 28, 1998 – The Credit Union Membership Access Act is passed by the U.S. Senate.

Aug. 7, 1998 – President Bill Clinton signs the Credit Union Membership Access Act into law and with it restores expansion privileges and provides for multiple common-bond credit unions. The act also requires the NCUA to create a system of prompt corrective action. This system sets the minimal capital ratios that a credit union must maintain and establishes triggers that limit the activities of a federally insured credit union should it drop below those levels.

2000

By the end of 2000, the credit union system has 10,316 federally insured credit unions, nearly $438 billion in assets and more than 77 million members.

Geoff Bacino is appointed to the NCUA Board. He serves from January 2001 until December 2001.

2001

The NCUA implements the risk-based, examination-scheduling program and approves collection of quarterly Call Reports to obtain data from credit unions.

NCUA Board Member Dennis Dollar becomes Chairman. He serves as NCUA Chairman until 2004.

2002

Debbie Matz is appointed to the NCUA Board. She serves until 2005.

JoAnn M. Johnson is appointed to the Board.

2004

JoAnn M. Johnson becomes NCUA Board Chairman. She serves as Chairman until July 2008.

The NCUA Board changes the name of the Office of Credit Union Development to the Office of Small Credit Union Initiatives, reflecting the importance the agency places on helping small, low-income and newly chartered credit unions thrive in an ever-changing and competitive financial services marketplace. In 2017, the Office of Small Credit Union Initiatives becomes the Office of Credit Union Resources and Expansion to reflect the addition of the NCUA’s chartering, field of membership, and minority depository institution preservation functions to its responsibilities.

2005

Rodney E. Hood is appointed to the Board and serves as Vice Chairman from 2005 until August 2009.

Christiane “Gigi” Hyland is appointed to the Board. She serves until 2012.

2007

The financial crisis that will eventually devastate the nation’s economy and threaten the existence of the credit union system becomes evident. Banks, retirement plans, and investment firms that invested heavily in securities that included subprime mortgages see mounting losses as foreclosures begin to rise and the value of those assets declines. The nation officially enters the recession in December. By official reckoning, the recession — the most severe since the 1930s — runs until June 2009, though the effects would last several years longer. More than 8 million Americans lose their jobs. The net worth of U.S. households and non-profit organizations falls by $15 trillion.

2008

July 29, 2008 – Michael E. Fryzel is sworn in as NCUA Board Chairman. He serves in this role until August 2009.

July 29, 2008 – Michael E. Fryzel is sworn in as NCUA Board Chairman. He serves in this role until August 2009.

Sept. 6, 2008 – Mortgage giants Fannie Mae and Freddie Mac are placed into conservatorship.

Sept. 15, 2008 – Lehman Brothers files for bankruptcy. Many observers mark this event as the start of the financial crisis of 2008–2009.

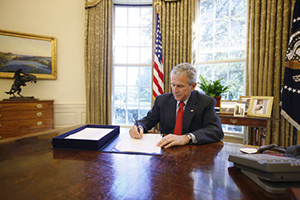

Sept. 30, 2008 – President George W. Bush signs the Consolidated Security, Disaster Assistance, and Continuing Appropriations Act, 2008, which contains provisions temporarily removing a cap of $1.5 billion on the Central Liquidity Facility, allowing the facility to borrow up to its authorized limit to lend to credit unions to meet short-term liquidity needs. The lending limit increases to $41.5 billion.

Oct. 3, 2008 – President George W. Bush signs the Emergency Economic Stabilization Act, creating the $700 billion Troubled Asset Relief Program, and temporarily raises FDIC and the NCUA deposit insurance coverage from $100,000 per depositor to $250,000 per depositor through Dec. 31, 2009.

Oct. 16, 2008 – The NCUA Board approves the Temporary Corporate Credit Union Liquidity Guarantee Program, providing a full faith and credit guarantee of the timely payment of principal and interest on certain unsecured debt of participating corporate credit unions.

Oct. 28, 2008 – The Treasury buys $125 billion worth of preferred stock of nine banks in its first TARP funding wave.

Nov. 20, 2008 – Fannie and Freddie suspend mortgage foreclosures until January 2009.

Dec. 9, 2008 – The NCUA Board approves the creation of the Credit Union System Investment Program and the Homeowners Affordability Relief Program to help credit unions weather increasing financial stress.

Dec. 31, 2008 – Nineteen consumer-owned credit unions fail in 2008, resulting in a loss of $232 million to the National Credit Union Share Insurance Fund.

2009

Jan. 28, 2009 – The NCUA Board announces the Temporary Corporate Credit Union Share Guarantee Program, providing a full faith and credit guarantee of uninsured shares at all corporate credit unions through February 2009 and establishing a voluntary guarantee program for uninsured shares of credit unions through December 2010. The Board also approves a $1 billion capital purchase in U.S. Central Federal Credit Union.

Jan. 28, 2009 – The NCUA Board announces the Temporary Corporate Credit Union Share Guarantee Program, providing a full faith and credit guarantee of uninsured shares at all corporate credit unions through February 2009 and establishing a voluntary guarantee program for uninsured shares of credit unions through December 2010. The Board also approves a $1 billion capital purchase in U.S. Central Federal Credit Union.

Feb. 17, 2009 – President Barack Obama signs the $787 billion American Recovery and Reinvestment Act.

March 20, 2009 – The NCUA Board conserves the two largest corporate credit unions: U.S. Central Federal Credit Union and Western Corporate Federal Credit Union. These conservatorships were necessary to manage catastrophic losses on investments, while sustaining critical liquidity and payment services to consumer-owned credit unions.

May 21, 2009 – The NCUA Board revises and extends the Temporary Corporate Credit Union Liquidity Guarantee Program to cover unsecured debt obligations issued on or before June 30, 2010 and maturing on or before June 30, 2017.

Aug. 24, 2009 – Debbie Matz becomes Chairman of the NCUA Board. She serves as Chairman until May 2016. Michael Fryzel continues to serve as a NCUA Board Member until August 26, 2014.

Dec. 16, 2009 – President Barack Obama signs the Fiscal Year 2010 Consolidated Appropriations Act. This act includes two provisions for credit unions. The Central Liquidity Facility secured full lending authority for 2010, allowing the facility to continue to meet the liquidity needs of credit unions. In addition, the appropriation for the Community Development Revolving Loan Fund was increased by $250,000 to $1.25 million.

Dec. 31, 2009 – In 2009, 27 consumer-owned credit unions fail, costing the National Credit Union Share Insurance Fund $150 million.

2010

July 21, 2010 – President Barack Obama signs into law the Dodd-Frank Wall Street Reform and Consumer Protection Act that made permanent the $250,000 insurance protection for shares and deposits.

July 21, 2010 – President Barack Obama signs into law the Dodd-Frank Wall Street Reform and Consumer Protection Act that made permanent the $250,000 insurance protection for shares and deposits.

Sept. 24, 2010 – The NCUA Board announces the Corporate System Resolution Program, a multi-stage plan for stabilizing the corporate credit union system, conserving an additional three corporate credit unions, providing short-term and long-term funding to resolve a portfolio of residential mortgage-backed securities, commercial mortgage-backed securities, other asset-backed securities and corporate bonds held by the failed corporate credit unions, and establishing a new regulatory framework for corporate credit unions,

Oct. 1, 2010 – U.S. Central Federal Credit Union and Western Corporate Federal Credit Union are placed into liquidation. U.S. Central Bridge Corporate Federal Credit Union and Western Bridge Corporate Federal Credit Union, which were chartered by the NCUA, assume certain operations of U.S. Central Corporate Federal Credit Union and Western Corporate Federal Credit Union. The two bridge corporate credit unions were created to prevent disruption of vital services to consumer-owned credit unions and facilitate an orderly wind-down over 24 months.

Oct. 4, 2010 – The NCUA hires national personal finance expert Suze Orman as part of a national public information campaign to inform credit union members and the public about the safety of credit union share deposits insured by the NCUA. During the campaign, more than 190 million Americans learn that federally insured credit unions are a safe place to save.

Oct. 27, 2010 – The NCUA finalizes the first NCUA Guaranteed Note sale. The NCUA Guaranteed Notes program provided long-term funding for billions of dollars of legacy assets formerly held in the securities portfolios of the failed corporate credit unions.

Oct. 31, 2010 – Members United Corporate Federal Credit Union and Southwest Corporate Federal Credit Union are placed into liquidation.

Nov. 30, 2010 – Constitution Corporate Federal Credit Union is placed into liquidation.

Dec. 31, 2010 – In 2010, 28 consumer-owned credit unions failed, resulting in $229 million in losses to the National Credit Union Share Insurance Fund. At the end of 2010, there were 7,339 credit unions with more than $914 billion in assets and nearly 90.5 million members.

2011

Jan. 1, 2011 – The NCUA established the Office of Minority and Women Inclusion that works to ensure equal opportunities for everyone in NCUA’s workforce programs and contracts. The office also assesses the diversity policies and practices of credit unions regulated by the NCUA.

March 9, 2011 – NCUA launches MyCreditUnion.gov, a website that provides consumers of all ages with in-depth personal finance information.

June 20, 2011 – The NCUA becomes the first federal financial institutions regulator to file suit in federal court against Wall Street firms to recover losses from sales of faulty mortgage-backed securities. The first lawsuits are filed against J.P Morgan Securities LLC and RBS Securities Inc. The agency eventually files 26 suits against 32 defendants in federal courts in California, Kansas, and New York related to corporate credit union losses. Net recoveries of these legal actions, to date, exceed $5.1 billion.

2012

April 11, 2012 – The NCUA launches a financial literacy micro-site, Pocket Cents, which provided information about the benefits of credit unions and the importance of making smart financial decisions. Pocket Cents was merged into MyCreditUnion.gov at the end of 2018.

June 1, 2012 – Federally insured credit union assets exceed $1 trillion for the first time.

July 6, 2012 – The NCUA closes Western Bridge Corporate Federal Credit Union

Aug. 12, 2012 – To streamline the low-income designation approval process, the NCUA notifies more than 1,000 federal credit unions directly of their eligibility. The designation provides several benefits, including access to supplemental capital, eligibility for loans and grants from the Community Development Revolving Loan Fund, ability to provide unlimited member business loans, and assistance from the NCUA. By the end of 2012, 690 additional federal credit unions with 7.5 million members and nearly $65.9 billion in assets accept designation a low-income credit union.

Oct. 29, 2012 – The NCUA closes U.S. Central Bridge Corporate Federal Credit Union.

Nov. 2, 2012 – The NCUA makes the last payment under the Temporary Corporate Credit Union Liquidity Guarantee Program related to the maturity of the asset management estates’ medium-term notes.

Nov. 11, 2012 – The NCUA develops and implements the National Supervision Policy Manual. The manual created uniform operations and procedures for supervision throughout the country and improved the agency’s ability to operate efficiently across regions.

Dec. 31, 2012 – The last of the special liquidity guarantee programs put into place during the financial crisis, the Temporary Corporate Credit Union Share Guarantee program, expires.

2013

Jan. 1, 2013 – The Office of National Examinations and Supervision begins operations. This office supervises the nation’s corporate credit unions and credit unions $10 billion or more in assets.

Jan. 4, 2013 – The NCUA obtains more than $1.42 billion in gross recoveries from the U.S. government’s historic settlement with JPMorgan Chase for selling faulty mortgage-backed securities to five corporate credit unions that failed in 2008–2010.

Jan. 6, 2013 – To reduce regulatory burdens, NCUA changes the definition of a small, non-complex credit union to those entities with less than $50 million in assets, up from the prior $10 million in assets threshold.

Aug. 14, 2013 – Rick Metsger joins the NCUA Board.

Sept. 23, 2013 – NCUA files suit against 13 international banks alleging violations of federal and state anti-trust laws through their manipulating of interest rates in the London Interbank Offered Rate system, or LIBOR.

Dec. 31, 2013 – The NCUA reports the entire projected range of remaining assessments is negative, indicating no need for future assessments and the potential for a distribution of surplus funds.

2014

Jan. 1, 2014 – Corporate credit unions convert from the Corporate Rating Information System to the CAMEL rating system. The change reduces the number of complexities in supervising the corporate system and the consumer credit union system, streamlines reporting and provides a uniform measure of performance.

Jan. 23, 2014 – The NCUA Board approves a final rule allowing certain well-managed federal credit unions to utilize derivatives as a risk-management tool.

April 24, 2014 – The NCUA Board adopts a rule requiring stress testing and capital planning for credit unions with more than $10 billion in assets.

Aug. 26, 2014 – J. Mark McWatters is sworn in as a member of the NCUA Board. He will serve as a Board Member until January 23, 2017.

Sept. 18, 2014 – Rick Metsger is designated as Vice Chairman of the NCUA Board. He will serve in this role until May 1, 2016.

Dec. 31, 2014 – First calendar year-end that the Stabilization Fund shows a positive net position of $0.2 billion, up from a peak deficit of $7.5 billion.

2015

April 30, 2015 – The NCUA Board approves a final rule that more clearly defines which associational groups qualify for membership in federal credit unions. As a result, 12 categories of associational groups can be added to a federal credit union’s field of membership without the credit union having to provide information that these groups are valid associations.

July 23, 2015 – The NCUA Board approves a final rule eliminating the regulatory cap on investments in fixed assets.

Sept. 17, 2015 – The NCUA Board approves a final rule that raises the asset ceiling for what is defined as a small credit union from $50 million to $100 million.

Oct. 15, 2015 – The NCUA Board approves a final rule updating the agency’s risk-based capital requirements.

2016

Feb. 18, 2016 – The NCUA Board approves a final rule that changes the agency’s regulations governing member business lending and provides credit unions with greater flexibility to make commercial lending decisions.

Feb. 18, 2016 – The NCUA Board approves a final rule that changes the agency’s regulations governing member business lending and provides credit unions with greater flexibility to make commercial lending decisions.

May 2, 2016 – President Barack Obama designates Rick Metsger as Chairman of the NCUA Board. He serves in this capacity until Jan. 22, 2017.

July 21, 2016 – The NCUA Board retires two agency performance goals requiring the examination each calendar year of all federally insured, state-chartered credit unions with more than $250 million in assets, and every federal credit union. The change provides the NCUA greater flexibility to schedule exams when needed.

Oct. 24, 2016 – The NCUA repays $1 billion borrowing from the U.S Treasury. The NCUA’s $6 billion borrowing line with Treasury remains available to satisfy future agency contingent funding needs, including obligations of the NCUA Guaranteed Note Program (NGN).

Oct. 27, 2016 – The NCUA Board approves comprehensive changes to the agency’s field-of-membership regulations, allowing more Americans to become eligible for credit union membership.

Nov. 17, 2016 – The NCUA approves the implementation of an extended examination cycle for well-managed, low-risk federal credit unions with assets of less than $1 billion.

2017

Jan. 23, 2017 – President Donald J. Trump designates J. Mark McWatters as Acting NCUA Chairman. He later becomes NCUA Board Chairman on June 23, 2017, and serves in this role until April 8, 2019. Rick Metsger continues to serve as a Board Member until April 8, 2019.

July 20, 2017 – The NCUA Board proposes to close the Temporary Corporate Credit Union Stabilization Fund four years ahead of the previously anticipated 2021 closure date.

July 21, 2017 – The NCUA announces it is restructuring the agency to improve efficiency and effectiveness. Specifically, the NCUA will consolidate its regional structure by closing its offices in Albany, NY, and Atlanta, GA, by the end of 2018. The agency also consolidated its credit union development, grants, and loans, minority depository institutions programs, and chartering and field-of-membership functions into the new Office of Credit Union Resources and Expansion, along with other improvements.

Sept. 28, 2017 – The NCUA Board approves the closing of the Stabilization Fund on Oct. 1, 2017.

Oct. 19, 2017 – The NCUA Board approves final rules enhancing the appeals process for credit unions if they have issues or concerns with agency decisions and supervisory determinations.

Dec. 11, 2017 – President Donald J. Trump signs an Executive Order establishing the new official seal for the NCUA. The new design brings the agency’s seal more in line with the seals of other federal financial services regulators.

2018

Feb. 15, 2018 – The NCUA Board approves a Share Insurance Fund distribution of $736 million to eligible federally insured credit unions that was paid in the third quarter of 2018.

April 19, 2018 – The NCUA Board approves a final rule reducing regulatory burden on federally insured credit unions with assets of $10 billion or greater by removing certain current capital planning and stress testing requirements.

June 21, 2018 – The NCUA Board approves a final rule to provide members of federally insured credit unions with greater transparency when those credit unions seek voluntary mergers.

June 21, 2018 – The NCUA Board amends its chartering and field-of-membership rules. With this change, federal credit unions have the option of using a narrative approach to establish the existence of a well-defined local community in their applications.

July 23, 2018 – The NCUA pays dividends to more than 5,700 institutions eligible for the $735.7 million Share Insurance Fund distribution.

Oct. 18, 2018 – The NCUA Board approves a final rule delaying the effective date of NCUA’s 2015 risk-based capital rule for one year, from Jan. 1, 2019, to Jan. 1, 2020. The rule also amends the definition of a “complex” credit union for risk-based capital purposes by increasing the asset threshold in the rule from $100 million to $500 million.

2019

Jan. 7, 2019 – The NCUA consolidates from five to three regions, closing the regional offices in Albany and Atlanta. The three newly reorganized regional offices are the Eastern, Southern, and Western Regions.

March 7, 2019 – The NCUA Board approves a $160.1 million equity distribution from the Share Insurance Fund that was paid to eligible credit unions in the second quarter of 2019.

April 8, 2019 – Rodney E. Hood is sworn in for a second time as a member of the NCUA Board and is designated as the eleventh NCUA Chairman by President Donald J. Trump. J. Mark McWatters continues to serve as a Board Member until Nov. 20, 2020. Mr. Hood serves as NCUA Chairman until Jan. 20, 2021.

April 8, 2019 – Todd M. Harper is sworn in as a member of the NCUA Board. He serves in this capacity until Jan. 20, 2021.

April 30, 2019 – The NCUA and the U.S. Small Business Administration launch a three-year collaborative effort to bring small businesses and credit unions together and expand awareness about SBA programs.

July 18, 2019 – The NCUA Board approves a final rule that raises the threshold for commercial real estate transaction appraisals from $250,000 to $1 million.

Aug. 20, 2019 – The United States Court of Appeals for the District of Columbia Circuit upholds much of the NCUA’s 2016 field-of-membership regulations changes.

Sept. 19, 2019 – The NCUA Board adopts a final payday alternative loans rule enhancing credit unions’ ability to serve members who need short-term, small-dollar loans.

Oct. 24, 2019 – The NCUA Board finalizes a rule that raised the threshold on the level of public unit and non-member shares a credit union can receive.

Nov. 21, 2019 – The NCUA Board approves a final policy statement that extends “second-chance” opportunities to job applicants with minor, non-violent criminal offenses in their past.

Dec. 12, 2019 – The NCUA Board approves a two-year delay of the implementation of the risk-based capital rule. The effective date of the rule moves to Jan 1, 2022.

2020

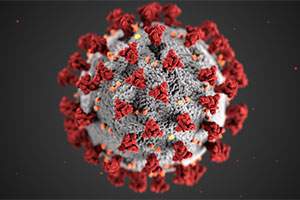

Jan. 27, 2020 – The U.S. Department of Health and Human Services declares a public health emergency for the entire United States to aid the nation’s healthcare community in responding to the COVID-19 pandemic.

Jan. 27, 2020 – The U.S. Department of Health and Human Services declares a public health emergency for the entire United States to aid the nation’s healthcare community in responding to the COVID-19 pandemic.

March 9, 2020 – The NCUA and other federal financial regulators issue a joint statement encouraging credit unions and other financial institutions to work with customers and members affected by financial and economic disruptions resulting from the COVID-19 pandemic.

March 16, 2020 – The NCUA issues a Letter to Credit Unions that outlines several strategies credit unions may consider when determining how to address the challenges associated with COVID-19.

March 25, 2020 – The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is signed into law in response to the COVID-19 pandemic. This law temporarily provides the NCUA Board with the power to expand access to and increase the borrowing authority for the Central Liquidity Facility and allows credit unions to provide guaranteed loans to businesses and self-employed individuals through the U.S. Small Business Administration’s paycheck protection program, among other relief measures.

April 13, 2020 – The NCUA Board approves changes to the Central Liquidity Facility to supplement the legislative changes resulting from the CARES Act while adding even greater flexibility and relief for member credit unions.

April 16, 2020 – The NCUA Board approves a final rule increasing the threshold level where an appraisal is not required for residential real-estate related transactions from $250,000 to $400,000.

April 24, 2020 – The Paycheck Protection Program and Health Care Enhancement Act is signed into law that provides about $484 billion in additional funding for coronavirus relief. The additional funding includes an additional $310 billion for the Paycheck Protection Program, as well as a provision for credit unions, small banks, and community lenders that serve businesses in minority, underserved, and rural communities. Specifically, $30 billion is allocated to community lenders, small banks, and credit unions with consolidated assets of less than $10 billion and $30 billion allocated specifically to medium-sized banks and credit unions with consolidated assets between $10 billion and $50 billion.

June 9, 2020 – The NCUA and the Export-Import Bank of the United States launch a three-year collaborative effort to expand awareness about EXIM’s programs.

June 29, 2020 – The United States Supreme Court denies an appeal from the American Bankers Association to review the NCUA’s field-of-membership rule introduced in 2016, ending nearly four years of litigation.

July 30, 2020 – The NCUA Board approves a final rule that would help facilitate greater access to safe and affordable financial services by changing the agency’s chartering and field-of-membership regulations for community charter approvals, expansions, or conversions.

Oct. 19, 2020 – The NCUA launches its financial inclusion initiative, ACCESS, or Advancing Communities through Credit, Education, Stability, and Support.

Dec. 14, 2020 – Kyle S. Hauptman is sworn in as a Board Member of the NCUA.

Dec. 17, 2020 – The NCUA Board approves a final rule that permits low-income designated credit unions, complex credit unions, and new credit unions to issue subordinated debt for purposes of regulatory capital treatment.

Dec. 27, 2020 – The Consolidated Appropriations Act is signed into law and extends several provisions of the CARES Act and the Paycheck Protection Program and Health Care Enhancement Act. The extension continues providing the Central Liquidity Facility with increased flexibility and borrowing authority to support the liquidity needs of the system and the Share Insurance Fund through Dec. 31, 2021. The act also extends, and provides additional support for, the Paycheck Protection Program through March 31, 2021.

2021

Jan. 14, 2021 – The NCUA Board approves a final rule that clarifies that corporate credit unions may purchase subordinated debt instruments issued by consumer credit unions.

Jan. 20, 2021 – President Joseph R. Biden, Jr. designates NCUA Board Member Todd M. Harper as the twelfth Chairman of the NCUA Board.

Feb. 18, 2021 – The NCUA Board approves a final rule amending the NCUA’s regulation governing the requirements for a share account to be separately insured as a joint account. The final rule provides federally insured credit unions with an alternative method to satisfy the membership card or account signature card requirement.

March 18, 2021 – The NCUA Board approves a temporary final rule that permits federally insured credit unions to use asset data as of March 31, 2020, to determine applicability of capital planning and stress testing requirements under the NCUA’s regulations. This data will also determine regional or national supervision of federally insured credit unions.

March 18, 2021 – The performance of the asset management estates that comprise the agency’s Corporate System Resolution Program means that the liquidating agent for U.S. Central Federal Credit Union, Members United Corporate Federal Credit Union, and Southwest Corporate Federal Credit Union the NCUA will be able to distribute $368 million to member capital account holders. Approximately 2,000 credit unions received a distribution in April 2021.

April 22, 2021 – The NCUA Board renews an interim final rule that makes two temporary changes to the NCUA’s prompt corrective action regulations. The first change temporarily reduces the earnings retention requirement for federally insured credit unions classified as adequately capitalized. The second change temporarily permits an undercapitalized credit union to submit a streamlined net worth restoration plan if it becomes undercapitalized predominantly because of share growth. This interim final rule is substantively similar to the interim final rule approved by the Board in May 2020.

May 20, 2021 – The NCUA Board approves a final rule modernizing the NCUA’s derivatives rule by moving it to a more principles-based approach while retaining essential safety and soundness components. It also includes guardrails, such as training and strong internal controls.

May 20, 2021 – The NCUA Board approves the issuance of a notice and request for comment on the methodology used to set the National Credit Union Share Insurance Fund’s normal operating level.

May 31, 2021 – The SBA’s Paycheck Protection Program (PPP), a COVID-related response program designed to support small business during the pandemic expires.

June 24, 2021 – The Board approves a final rule that removes the prohibition on the capitalization of interest in connection with loan workouts and modifications.

June 24, 2021 – The NCUA Board approves a final rule that phases-in the day-one adverse effects on regulatory capital that may result from fully implementing the current expected credit losses (CECL) accounting methodology.

July 22, 2021 – The NCUA Board approves a request for information on the current and potential impact digital assets, cryptocurrency, decentralized finance, and other related technologies will have on federally insured credit unions.

Aug. 12, 2021 – The NCUA begins industry-wide transition to using NCUA Connect, Admin Portal, Modern Examination and Risk Identification Tool (MERIT), and Data Exchange Application (DEXA) applications. The agency facilitates and completes all internal and external user training sessions between August 18, and December 14, 2021.

Sept. 8, 2021 – The NCUA hosts a webinar for credit unions about the modernized examination tools and provides an overview of how the modernization streamlines the examination process by allowing credit unions to securely transmit requested information, provide status updates on examination findings, and retrieve completed examination reports.

Oct. 21, 2021 – The NCUA Board approves a final rule that adds the “S” (Sensitivity to market risk) component to the existing CAMEL rating system, thus updating the rating system from CAMEL to CAMELS, and redefines the “L” (Liquidity risk) component. The benefits of adding the “S” component are to enhance transparency and allow the NCUA and federally insured, consumer and corporate credit unions to better distinguish between liquidity risk (“L”) and sensitivity to market risk (“S”). The addition of “S” also enhances consistency between the supervision of credit unions and financial institutions supervised by the other banking agencies.

Oct. 21, 2021 – The NCUA Board approves a final rule that amends the NCUA’s credit union service organization regulation. The final rule expands the list of permissible activities and services for CUSOs to include originating any type of loan that a federal credit union may originate; and grants the NCUA Board additional flexibility to approve permissible activities and services outside of notice-and-comment rulemaking.

Oct. 25, 2021 – The NCUA launches the Automated Cybersecurity Evaluation Toolbox, or ACET, application that provides credit unions the capability to conduct a maturity assessment aligned with the Federal Financial Information Council’s Cybersecurity Assessment Tool. Using the assessment within the toolbox allows institutions of all sizes to easily determine and measure their own cybersecurity preparedness over time.

Nov. 29, 2021 – The NCUA Board issues a joint letter requesting that Congress make permanent the enhancements to the Central Liquidity Facility contained in the CARES Act.

Dec. 16, 2021 – The NCUA Board approves a final rule that simplifies the risk-based capital requirements for eligible complex credit unions. Under the final rule, a complex credit union that maintains a minimum net worth ratio that meets other qualifying criteria is eligible to opt into the complex credit union leverage ratio (CCULR) framework if they have a minimum net worth ratio of 9 percent.

Dec. 21, 2021 – The NCUA Board approved an extension of the effective date of its temporary final rule that modified certain regulatory requirements to help ensure that federally insured credit unions remain operational and can address economic conditions caused by the COVID–19 pandemic. These temporary modifications will remain effective until Dec. 31, 2022.

Dec. 31, 2021 – The Consolidated Appropriations Act, 2021, which extended several pandemic-related relief measures originated in the CARES Act, expires.

2022

Jan. 27, 2022 – The NCUA Board approves a proposed rule that would require boards of directors at federal credit unions to establish and adhere to processes for succession planning.

Feb. 17, 2022 – The NCUA Board approves a notice of proposed rulemaking that would amend the NCUA’s regulations to change the asset threshold for assigning federally insured credit unions to the Office of National Examinations and Supervision (ONES).

Feb. 17, 2022 – The NCUA Board approves an interim final rule extending certain regulatory requirements to help ensure that federally insured credit unions remain operational and liquid during the COVID-19 pandemic.

March 17, 2022 – The NCUA Board unanimously approves the NCUA’s 2022–2026 Strategic Plan that outlines the agency’s strategic goals and objectives for the next five years.

June 8, 2022 – The U.S. Senate confirms Todd M. Harper to be a member of the NCUA Board for a term expiring on April 10, 2027.

July 11, 2022 – Todd Harper is sworn in by FHFA Director Sandra Thompson to serve a full term as on the Board.

July 21, 2022 – The NCUA Board approves a proposed rule that would require a federally insured credit union to notify the NCUA as soon as possible but no later than 72 hours after they reasonably believe that a reportable cyber incident has occurred.

July 21, 2022 – The NCUA Board approves a final rule that changes the asset threshold for assigning federally insured credit unions to ONES’s supervision to $15 billion or more in assets.

Sept. 22, 2022 – The NCUA Board unanimously approves a proposed rule that would amend the standard federal credit union bylaws on when a credit union member may be expelled for cause.

Sept. 22, 2022 – The NCUA Board unanimously approves a proposed rule that would extend the regulatory capital treatment of grandfathered secondary capital to eligible low-income credit unions participating in the U.S. Department of the Treasury’s Emergency Capital Investment Program or in other federal programs.

Oct. 17, 2022 – The NCUA returns to onsite operations following the COVID-19 pandemic.

Oct. 20, 2022 – The NCUA Board unanimously approves the NCUA’s new enterprise risk appetite statement, which provides guidance on the amount of risk the agency is willing to undertake in pursuit of its objectives.

Dec. 1, 2022 – By notation vote, the NCUA Board approves moving management and oversight of the Asset Management and Assistance Center from the Southern Region to an independent office, effective Jan. 1, 2023.

Dec. 1, 2022 – The NCUA Board approves the transfer of examination and supervision responsibilities for Ohio from the Eastern Region to the Southern Region, effective Jan. 1, 2023.

Dec. 15, 2022 – The NCUA Board unanimously approves a proposed rule that would amend the NCUA’s regulations on loan participations, eligible obligations, and notes of liquidating credit unions. This proposed rule is designed to facilitate greater relationships between credit unions and fintechs.

Dec. 31, 2022 – The Central Liquidity Facility’s agent membership authority that was initially authorized under the CARES Act, expires, drastically limiting the amount of liquidity available to credit unions in the event of a major liquidity crisis.

2023

Jan. 26, 2023 – The NCUA Board approves maintaining the current 18-percent interest rate ceiling for loans made by federal credit unions for a new eighteen-month period from March 11, 2023, through September 10, 2024. The staff analysis is available here.

Feb. 16, 2023 – The NCUA Board approves a final rule that requires a federally insured credit union to notify the NCUA as soon as possible, within 72 hours, after it reasonably believes a reportable cyber incident has occurred. The final rule goes into effect September 1, 2023.

Feb. 16, 2023 – The NCUA Board approves a proposed rule that would amend the NCUA’s chartering and field-of-membership rules through nine changes to enhance consumer access to safe, fair, and affordable financial services, especially in under-resourced communities.

March 16, 2023 – The NCUA Board approves a final rule on subordinated debt. Specifically, this final rule replaces the maximum permissible maturity of subordinated debt notes with a requirement that any credit union seeking to issue subordinated debt with maturities longer than 20 years demonstrate how such instruments would continue to be considered “debt.”

April 20, 2023 – NCUA Board approves a request for information seeking comments on current and future climate-related financial and natural disaster risks to federally insured credit unions, their related entities, their members, and the National Credit Union Share Insurance Fund.

May 25, 2023 – The NCUA Board approves a proposed rule that would add “war veterans’ organizations” to the definition of a “qualified charity” that a federal credit union may contribute to using a charitable donation account.

June 22, 2023 – The NCUA Board approves proposed changes to the interpretive ruling and policy statement on the agency’s Minority Depository Institution Preservation Program.