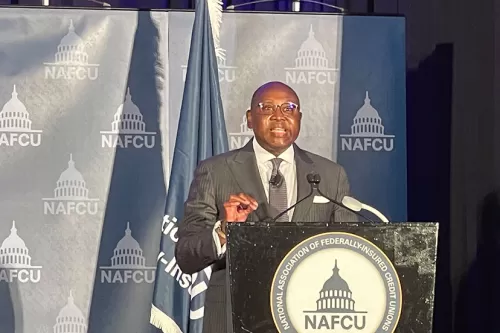

NCUA Board Member Rodney E. Hood addresses the audience at NAFCU's 2021 Congressional Caucus in Washington, D.C.

As Prepared for Delivery on September 14, 2021

Good morning! It’s a pleasure to be here today, and I’m delighted that so many are able to join us, both in-person and virtually.

I’m especially pleased that we’ve reached the point that this event could be hosted here in Washington D.C. While we all know the pandemic risk remains serious, we should be grateful that with more people receiving their vaccinations and reasonable precautions, we can feel more confident about returning to a more normal footing where we can gather together like this. After what we’ve gone through since the beginning of 2020, I certainly welcome the opportunity for togetherness and personal contact, and I know many of you do, too.

That type of personal contact is especially important for efforts like the Congressional Caucus. We know that writing letters and sending e-mails to your members of Congress about the issues that are important to the industry and your communities is effective. But to be able to talk directly with members and their staffs to explain those issues and tell them the stories of what your credit unions are doing for your members, is that much more effective.

And what a powerful story that is. Just look at the numbers from the last quarter, which showed federally insured credit unions reporting net income growth of $11.9 billion, an increase of 126.8 percent over the same period last year. Insured shares and deposits were up $196 billion, 14.2 percent over last year’s second quarter, to a total of $1.58 trillion. We’re also saw continued strong performance in loan growth, lower delinquency rates, and other key measures.

Moreover, credit unions played a vital role in limiting the damage from last year’s economic shock. Your institutions were on the front lines when it came to ensuring that guaranteed loans under the Paycheck Protection Program were dispensed wisely and efficiently at a time when that support was needed most. I imagine everyone here can share compelling stories about small enterprises, self-employed individuals, and local employers who were able to keep their doors open thanks to that timely investment. I encourage you to make a point of letting your elected representatives know about those successes — that’s an important story to tell.

Over the last 18 months, your institutions performed impressively during some of the most challenging times we’ve experienced. If the pandemic and the economic shock were a “stress test,” we can say that credit unions passed that test with flying colors.

But the goal here is not just to brag about what you achieved during the last year and a half, but to set the stage for what we hope to achieve in the years to come. You all know me well enough to know many of the key priorities that I’m working on as a member of the NCUA Board, things like:

- Ongoing efforts at reform to ensure that our regulatory system is effective without being excessive;

- Working with my board colleague Kyle Hauptmann to streamline the chartering process so we can see new credit unions established where they’re needed most;

- Encouraging my fellow regulators and members of Congress — as you may have seen last week — to get serious about clarifying the rules for financial services providers to conduct business with marijuana-related businesses. This is a long-overdue reform, given the rapidly changing legal environment around cannabis, hemp, and related products;

- Encouraging more uptake of innovative financial technology solutions by credit unions to help you to keep pace with the changing marketplace and to better meet your members’ needs; and

- Doing everything we can to promote great financial inclusion for all Americans.

I’ve spoken to many of you about these things, and many of you have shared with me your own perspectives on what we need to do to achieve these priorities. This is why I want to encourage you to take a leading role in communicating clearly about not only your institution’s needs but also the needs of the broader system. Don’t just sit back and defer to the NCUA, or to your trade associations — though to be sure, they do a great job on your behalf — to address those needs.

We need credit unions to stand up and advocate not only for your own institutions but for the industry as a whole. If you’re concerned by regulatory proposals out of the NCUA, make your voices heard through the public comment process. If you have an opportunity to meet with members of Congress, as you do this week, let them know what you need to better serve your members’ needs and strengthen your communities.

We know that, at this point, marijuana legalization is a matter of when, not if, so we should be providing the leadership now to bring that industry into the legitimate financial system by providing a clear legal framework at the federal level.

I can’t emphasize enough the importance of that kind of communication and cooperation. Of course, this should all be second nature to credit unions, which after all, are founded on the principles of cooperative leadership. Yes, you are participating in a competitive marketplace, but you also understand that, unlike a lot of other financial institutions, that cooperative impulse, working together to achieve shared ends, is in this industry’s DNA. And it’s a critical part of what keeps the industry strong and ensures the safety and soundness of the system.

We’ll have plenty of time to focus on these and other issues in more detail in the discussion session to follow. But I would like to close with a quote from Roy Bergengren, a pioneer of the U.S. credit union industry in the last century, who wrote that:

“The credit union of the future will be limited only by its vision. With courageous leadership, imaginative leadership not afraid of precedent, we shall open up new avenues of cooperative effort which must lead inevitably to the brotherhood of free men.”

Vision, courageous leadership, cooperative effort, I can’t think of a better summation of the principles that serve as the foundation of the credit union mission of “people helping people.” Those were very much the principles we saw at work over the last year and a half in your institutions, and I look forward to working with you to carry that same cooperative spirit of leadership forward.

Thank you.