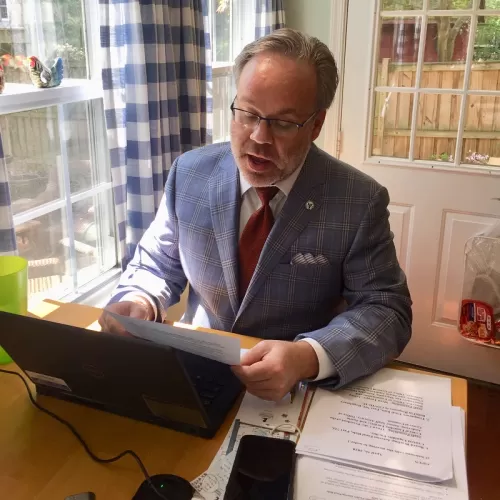

NCUA Board Member Todd M. Harper provides remarks from his home during the agency's April 2020 Board meeting.

As Prepared for Delivery on April 16, 2020

Thank you Chairman Hood, and thanks to Tim and Ian for your presentation, as well as to Uduak, Lou, Kenneth, Gira, and Frank for your hard work on this rulemaking.

So far, I have supported each item that has come before us today. I did so because these regulatory matters were temporary in timing, targeted in scope, and related to mitigating the effects of the COVID-19 pandemic on the credit union system.

In comparison, this final rule does not directly respond to the COVID-19 emergency. As a Board, we should focus our energies on protecting the people, including NCUA staff, credit union members, and employees, preparing the agency, and strengthening the system for what lies ahead. Rulemakings like increasing the appraisal threshold can wait as we prioritize a new economic reality. I, therefore, will oppose this rule.

With this rulemaking, we are putting the proverbial “cart before the horse” by raising the threshold before acting on an interagency rule to establish standards for automated valuation models, or AVMs. Although credit unions cannot solely rely on AVMs when calculating a written estimate of value, the estimates produced by AVMs may contribute to the valuation.

When we considered this proposal last fall, I noted the lack of quality control standards for AVMs. My concerns are not isolated. In 2018, a Federal Reserve Board study found that the “degree of precision” for AVMs was low and only half of AVM estimates were “within 10 percent of the sales price.”1

Congress also recognizes the problematic nature of AVM quotes.2 The Dodd-Frank Act required that AVMs adhere to quality control standards designed to ensure a high level of confidence in the estimates produced. To implement these standards, the law required the NCUA, the federal banking agencies, and the Appraisal Subcommittee to develop new rules. Nearly 10 years have passed since the Dodd-Frank Act became law. While there have been some interagency discussions about the AVM standards in recent months, regulators have moved at a glacial pace on that mandatory rulemaking.

Another troubling thing about this rule is the size of the threshold. Under the new appraisal threshold, 94 percent of residential mortgages underwritten by federally insured credit unions would be exempt. This excessive exemption is far from what Congress intended.

In fact, lawmakers recently asked the Government Accountability Office to study the appraisal threshold, including how to preserve the safety and soundness of the financial system and protect homeowners from mortgages with inaccurate valuations.3 Rather than rushing to loosen a standard in the midst of a dramatic economic downturn, we should wait to act on this issue until that independent analysis is complete and the economy stabilizes.

Moreover, the present economic downturn may eventually lead to lower home prices. If so, then credit union members whose mortgages relied on a written estimate of market value might find themselves in overinflated mortgages. Licensed and certified appraisers are more likely to identify, and adjust to, downward price trends than professionals with less training in estimating property values and AVMs, and whose estimates can lag the market and produce less precise estimates of market value.

Additionally, as noted in the final rule, written estimates of market value are less regulated than appraisals. And as the National Association of Federally Insured Credit Unions wrote in its comment letter, Chapter 10 of the NCUA’s Examiner’s Guide “provides little insight on the expectations for written estimates of market value.”

Before finalizing this rule, we should provide details about the training, expertise, and knowledge required by the independent parties who will be making written estimates of market value, as well a standard written format. However, to do that, the NCUA would have divert time away from our efforts to address the COVID-19 pandemic.

In closing, the matter before us is the wrong rule at the wrong time. It is neither temporary nor targeted. Instead, it is permanent and premature. In these challenging times, the NCUA should apply a laser-like focus that responds to the economic impacts caused by COVID-19.

And consistent with the best practices of consumer protection and the principles of safety and soundness, we should ensure that credit unions continue to meet their members’ pressing needs, many of whom have lost their jobs and some or all of their incomes in this crisis. Raising the appraisal threshold does not achieve the objective of supporting those who are now experiencing hard times through no fault of their own. Accordingly, I will vote no on this matter.