Regulatory Guidance

Regulatory Guidance

Regulatory Alerts / Feb 15, 2024

Letter to Credit Unions / Jan 22, 2024

Letter to Federal Credit Unions / Jan 18, 2024

Accounting Bulletin / Dec 20, 2023

Letter to Credit Unions / Oct 11, 2023

Sign Up for NCUA Express

Get the latest news and information from the NCUA.

Tools & Services

Tools & Services

Events Calendar

Events Calendar

Data & Insights

Data & Insights

View More

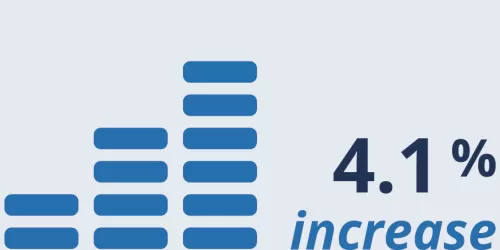

TOTAL ASSETS

Total assets in federally insured credit unions rose by $88 billion, or 4.1 percent, over the year ending in the fourth quarter of 2023, to $2.26 trillion.

MEMBERSHIP

Federally insured credit unions added 4.0 million members over the year, and credit union membership in these institutions reached 139.3 million in the fourth quarter of 2023.

NET WORTH

The credit union system's net worth increased by $8.7 billion, or 3.8 percent, over the year to $241.5 billion.